MCM BENEFITS

Join Us Today!

*Up to 300BPS Comp on HECM Loans (3%)

*Up to 200BPS Comp on Forwards/Non-QM (2%)

CRM/Dialer

Custom 1003 Application

1-on-1 Team Leader Support

Training Tools Available 24/7

Originate DSCR Loans in Most States—No State Specific License Required

Have All Your Questions Answered

Join Our On-Demand Info Session!

Here's What We'll Cover:

Walkthrough of Our Support & Loan Origination Process

Available Loan Programs

Growth Opportunities

Demo of Our Proprietary CRM

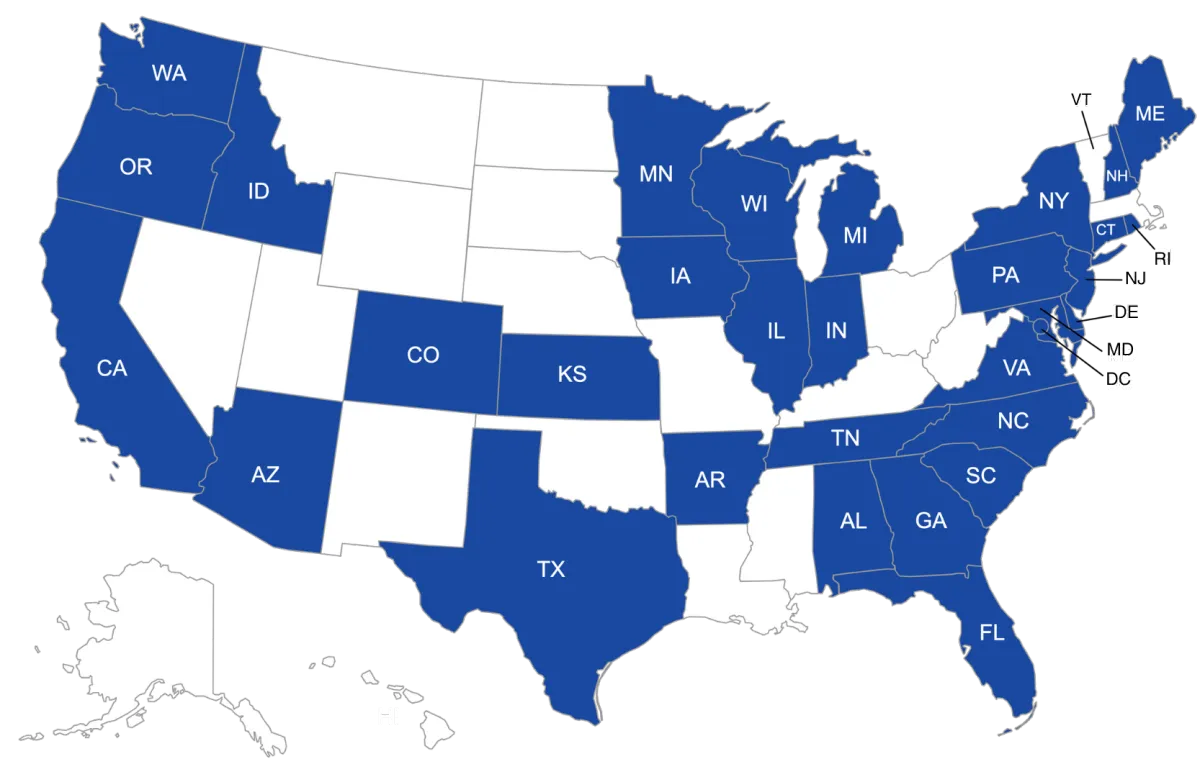

APPROVED RECRUITING STATES

** SC: Must be 75 miles from our Greenville office.

INFO SESSION REPLAY

Frequently Asked Questions

Do I need to be licensed to be hired by MCM?

Yes, you must be licensed to be hired by MCM.

What loan programs do you offer?

Traditional

FHA

Down Payment Assistance

VA

Conventional

USDA

Non-QM

DSCR

Bank Statements

Foreign National

ITIN

Asset Utilization

P&L

Reverse

And more...

Hard Money

Fix & Flip

Bridge

Is the position part time or full-time, remote or in person?

The position is fully remote and you are able to work the hours you choose.

How do I become a Tier 2 loan officer?

The goal for any loan officer we bring on is for them to become a Tier 2 loan officer. A Tier 2 loan officer is capable of independently originating loans and is familiar with our file flow and software. Generally, it should take no more than 2-4 loans for a loan officer to reach Tier 2

Is the position 1099 or W-2?

This position is classified as a W-2 position. However, we do offer the option for originators to be paid via 1099 for Business Purpose Loans ONLY.

Is equipment provided? Laptop, phone, etc…

No, equipment is not provided. Loan officers are expected to have their own phones, and computers. However, you will be given a business phone number to use.

Do you pay for licensing?

MCM does not cover any licensing costs for originators. MLO’s are responsible for their own licensing fees.

Is there a base salary, commission draw?

No, MCM does not offer a salary or commission draw with this position.

How do the leads work?

Leads are accessible through our CRM's Marketplace. Additionally, we provide comprehensive training on not only obtaining leads through the Marketplace but also on effectively generating your own leads without incurring any costs.

Testimonials (A Few Of Many)

MCM BENEFITS

UP TO 300BPS

*Up to 300BPS Comp on HECM Loans (3%)

*Up to 200BPS Comp on Conventional/Non-QM (2%)

CRM/Dialer

Custom 1003 Application

1 on 1 Team Leader Support

Training Tools Available 24/7

Originate DSCR Loans in Most States — No State Specific License Required

STILL NOT CONVINCED?

Join Our On-Demand Info Session! Here's What We'll Cover:

Walkthrough of Our Support & Loan Origination Process

Available Loan Programs

Growth Opportunities

Demo of Our Proprietary CRM

Q&A Session

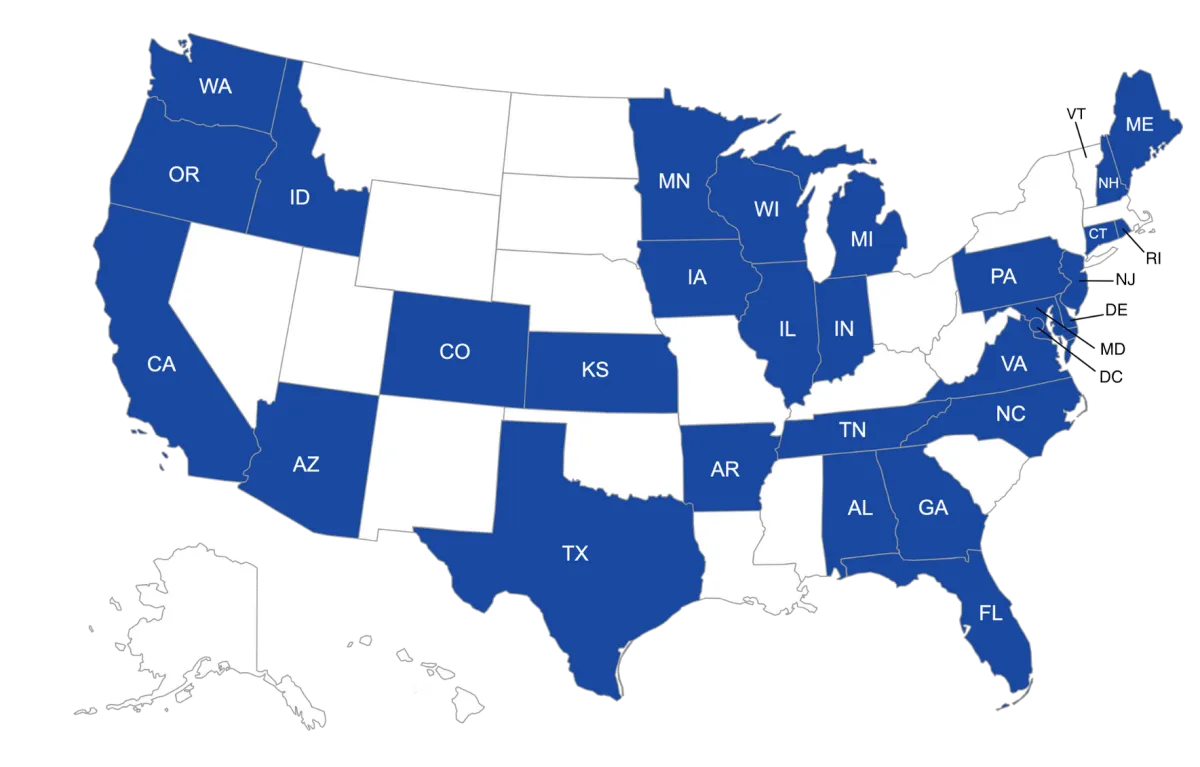

APPROVED RECRUITING STATES

INFO SESSION REPLAY

Frequently Asked Questions

Do I need to be licensed to be hired by MCM?

Yes, you must be licensed to be hired by MCM.

What loan programs do you offer?

Traditional

FHA

Down Payment Assistance

VA

Conventional

USDA

Non-QM

DSCR

Bank Statements

Foreign National

ITIN

Asset Utilization

P&L

Reverse

And more...

Hard Money

Fix & Flip

Bridge

Is the position part time or full-time, remote or in person?

The position is fully remote and you are able to work the hours you choose.

Is the position 1099 or W-2?

This position is classified as a W-2 position. However, we do offer the option for originators to be paid via 1099 for Business Purpose Loans ONLY.

Is equipment provided? Laptop, phone, etc…

No, equipment is not provided. Loan officers are expected to have their own phones, and computers. However, you will be given a business phone number to use.

Do you pay for licensing?

MCM does not cover any licensing costs for originators. MLO’s are responsible for their own licensing fees.

Is there a base salary, commission draw?

No, MCM does not offer a salary or commission draw with this position.

How do the leads work?

Leads are accessible through our CRM's Marketplace. Additionally, we provide comprehensive training on not only obtaining leads through the Marketplace but also on effectively generating your own leads without incurring any costs.

How do I become a Tier 2 loan officer?

The goal for any loan officer we bring on is for them to become a Tier 2 loan officer. A Tier 2 loan officer is capable of independently originating loans and is familiar with our file flow and software. Generally, it should take no more than 2-4 loans for a loan officer to reach Tier 2.

Testimonials (A Few Of Many)

Copyright 2025 © MCM Companies. All Rights Reserved.

NMLS ID # 213236. For licensing information, go to: www.nmlsconsumeraccess.org